Opening Night

Gerald R. Ford Amphitheater

By donating at a certain level, you may have access to closed rehearsals, presale ticket access, invitations to post-performance Receptions, premium seating, and more!

Underwrite a performance, musician, world premiere, music commission, or more! Underwriting opportunities start at the Platinum Dress Circle Level. All underwriters receive recognition in the Festival Program Book. Choose what you are passionate about and make a direct impact on the Vail Dance Festival!

There is a multitude of ways to financially support the Vail Dance Festival. Please review the options by clicking below.

We invite you to consider leaving a legacy gift to the Vail Dance Festival. Your gift will support the Festival today, tomorrow, and into the future and will serve as a meaningful tribute to your generosity. Creating a bequest, charitable gift annuity or giving appreciated stock may offer better tax savings for you than an outright gift of cash.

If you are a donor, you should have received email communications regarding presales and ticket redemption. The next donor presale happens just before public tickets go on sale for Dance for $20.24.

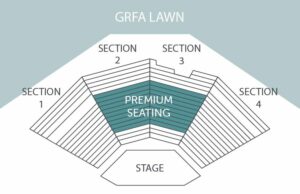

DONOR TICKETING BENEFITS: Silver Dress Circle donors and up ($1,500+) work with our convenient Donor Concierge to purchase tickets. Tickets in the premium seating section (covered pavilion seats in sections 2 &3) are held and reserved for donors at Gold Dress Circle and up ($3,000+). Donors at these levels need not worry about the presale ticket windows. Tickets in the premium seating sections are not released until all donors at the Gold Dress Circle level and above have processed their ticket orders.

If you are interested in viewing all donor benefits or would like to learn more about becoming a donor, click below.

Vail Dance Festival / Vail Valley Foundation

PO Box 6550

Avon, CO 81620

Please contact connect@vvf.org.

The Vail Dance Festival is a project of The Vail Valley Foundation.

Our tax ID Number is 74-2215035.

Restrictions may apply to receiving benefits if donors are giving through a donor-advised fund, private foundation, charitable trust or matching gift. Please contact your tax advisor with questions.